What is an EDI 812?

What is an EDI 812?

By Logicbroker | February 17, 2017

What is an EDI 812?

An EDI 812 is an electronic document that trading partners use to perform a credit/debit adjustment. It is very similar to a paper credit or debit memo. An 812 can be used by a merchant to inform a customer of a debit or credit to the amount they are being charged, in relation to a previously transmitted invoice (810) or previously received purchase order (850). In addition, a merchant may use the 812 to request an adjustment from a supplier.

The information found on an 812 document may refer to a specific PO or invoice, and contain detailed information containing item identification, quantity and the reason for the credit or debit. Typical reasons for an adjustment may include:

- Item defects

- Product ordered was not received

- Items were/are being returned

- Quality delivered differed from Quantity ordered

- Pricing error on the original PO or invoice

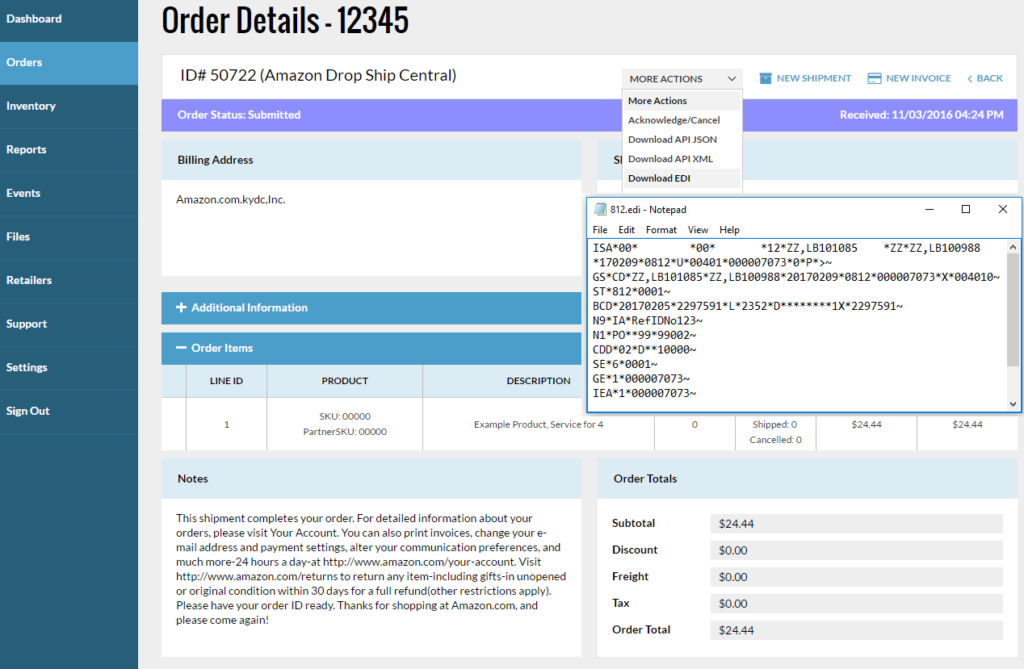

EDI 812 Format

EDI 812s enable businesses to streamline the supply chain by eliminating the need to receive debit/credit memos via fax or email and manually re-key the information into different systems. The automation also keeps the cost of business down as a whole because it frees up resources and reduces human error.

How do I send/receive an EDI 812?

It is fairly easy for a system to send/receive EDI 812s. For the most part, the transmitting is done through the Internet or Value Added Network (VAN). To keep EDI costs affordable, today most EDI transmission is done through the internet using AS2 or secure FTP, eliminating the need for an expensive VAN. The file is kept secure using encryption to keep the data safe.

Translating the EDI 812

Once an EDI 812 document has been received, it must be translated into a functional format for your system. Many organizations have their own standard set of definitions for EDI 812s and companies use a platform like logicbroker to configure and translate these different documents. Once the EDI 812 is translated, the information can be synced to your internal system of record such as an ERP – eliminating the need for manual data entry. Once the information exists in your systems, you can quickly process the debit or credit. As an EDI 812 related to a return only covers the financial aspect, an EDI 180 would be used to request or authorize the return.

To learn more, please contact us for more information.

Modern dropship & marketplace solutions have never been so easy.

Are you ready to drive growth and gain unparalleled speed to market with a modern, scalable dropship or marketplace program? Fill out the form below to get in touch with our team: